Views: 0 Author: Site Editor Publish Time: 2025-10-17 Origin: Site

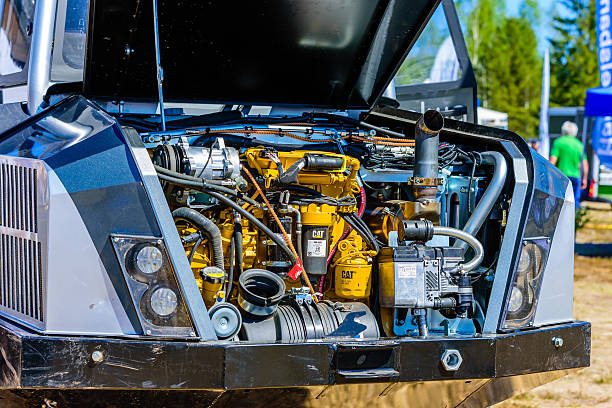

Cummins turbochargers are critical components for heavy-duty diesel engines, driving efficiency, power, and durability for B2B buyers across industries like trucking, construction, mining, agriculture, marine, and power generation. By compressing intake air, these turbochargers enable engines to deliver higher torque and horsepower while optimizing fuel consumption, a key factor for distributors and fleet operators seeking cost-effective solutions. In 2025, China's turbocharger manufacturing sector offers OEM-quality replacements at competitive prices, making it a prime destination for wholesale procurement and global export.

China's dominance in the turbocharger market stems from its advanced production capabilities, cost-efficient labor, and robust supply chain ecosystem. With a projected market growth of over 7% CAGR through 2030, Chinese manufacturers provide B2B buyers with scalable solutions for heavy-duty diesel engines, supported by innovations like variable geometry turbochargers (VGTs) and eco-friendly designs. This guide explores the top 10 Cummins turbocharger manufacturers in China, their technical strengths, and key considerations for importers and distributors aiming to secure reliable supply chains.

Turbochargers enhance engine performance by forcing extra air into the combustion chamber, crucial for heavy-duty diesel engines in high-load applications. For B2B buyers, this translates to reduced operational costs and compliance with 2025's stringent emission standards, such as China's National VI and Euro VI.

China's ability to produce OEM-quality turbochargers ensures compatibility with Cummins engines like ISX, QSB, and 6BT, meeting the needs of global distributors. These solutions offer 30-50% cost savings compared to Western OEMs, making them attractive for bulk orders.

With manufacturing hubs in Fengcheng, Wuxi, and Ningbo, China exports millions of turbochargers annually to over 100 countries. Advanced facilities and certifications like IATF16949 ensure reliability for B2B supply chains.

For B2B buyers and distributors, turbochargers are the backbone of heavy-duty diesel engine performance, transforming exhaust energy into mechanical power. This section examines their impact on efficiency, the aftermarket's growth, and emerging trends shaping wholesale procurement in 2025.

Turbochargers significantly enhance fuel efficiency and power output, critical for B2B applications in logistics, mining, and agriculture. By increasing oxygen density, they enable complete combustion, boosting torque by up to 20% and reducing fuel costs for fleet operators.

Innovations like ball-bearing centers and electronic actuators minimize turbo lag, ensuring instant throttle response. These advancements are vital for distributors supplying heavy-duty diesel engines in demanding environments.

In 2025, OEM-quality turbochargers from China comply with global emission standards, supporting B2B buyers in meeting regulatory requirements while maintaining performance.

The aftermarket for Cummins turbochargers in China has grown exponentially, driven by demand for cost-effective, OEM-equivalent replacements. Manufacturers leverage reverse engineering to produce parts matching Cummins' ISX, QSB, and ISM series, offering distributors competitive alternatives.

High-quality replacements deliver identical performance at 30-40% lower costs, enabling distributors to maximize margins on bulk orders for global markets.

Many Chinese manufacturers offer private labeling and tailored packaging, allowing B2B buyers to brand turbochargers for resale, strengthening their market position.

The turbocharger industry is evolving with technologies like VGTs, twin-turbo systems, and e-turbos, aligning with Cummins' electrification goals. These advancements cater to B2B buyers seeking future-proof solutions for heavy-duty diesel engines.

Chinese manufacturers are adopting recycled materials and energy-efficient processes, appealing to distributors prioritizing ESG compliance in their supply chains.

By 2025, over 40% of turbochargers will feature sensors for predictive maintenance, reducing failures by 30% and enhancing reliability for B2B applications.

Below is a detailed overview of the top 10 manufacturers, selected based on production capacity, OEM-quality standards, export volumes, and feedback from B2B buyers and distributors.

Elecdurauto is a trusted Cummins turbocharger manufacturer in China, serving global distributors with OE-level quality and factory-direct pricing.

OE-Level Quality: Strict quality control and dynamic balancing ensure performance equal to original Cummins parts.

Factory-Direct Supply: Transparent wholesale pricing and stable availability for importers and distributors.

Strong SKU & Reliable Lead Time: Over 30,000 SKUs for Cummins, Caterpillar, and Volvo engines with ready-to-ship stock.

Rigorous Testing & Warranty: Multi-stage inspection with an 18-month quality guarantee.

Systemized Supply Solutions: Complete turbo kits and component combinations for trucks, generators, and construction equipment.

Located in Fengcheng, China's turbocharger hub, PowerTech specializes in HX40W, HX50, and HE351 models, leveraging advanced balancing for B2B reliability.

Precision Technology: Robotic balancing ensures durability in extreme conditions.

Global Reach: Exports to Arctic mining and Asian shipping markets.

Wuxi BoostLine, based in Jiangsu, excels in OEM and aftermarket turbochargers, certified to ISO/TS16949 standards for wholesale markets.

Low Failure Rates: Rigorous testing ensures reliability for Southeast Asia and Europe.

Emission Efficiency: Upgrades reduce emissions by 10%, appealing to eco-conscious buyers.

Ningbo HighFlow focuses on 6BT, ISX15, and QSB6.7 turbochargers, offering precision-cast components and CHRA for B2B distributors.

Tailored Solutions: Custom designs enhance boost pressure for specific engines.

Global Supply: Partners with European aftermarket brands for OEM-equivalent parts.

Guangzhou DieselTech provides OEM-equivalent turbochargers for Cummins and MAN engines, emphasizing speed and small MOQ for distributors.

Quick Turnaround: Ships in under two weeks, ideal for urgent orders.

Small MOQ: Supports emerging distributors with low order thresholds.

Shanghai TurboWorks serves truck, construction, and marine sectors with performance-tested turbochargers for long-term B2B cooperation.

Batch Testing: Provides detailed performance reports for each order.

Cooling Systems: Enhances durability for continuous operation.

TurboMach produces HX55, HE500, and K27 series, approved for aftermarket brands in Europe and South America.

High-Volume Output: Supports large fleets with consistent quality.

Reliability: Designed for industrial heavy-duty diesel engines.

EngineBoost offers turbochargers and cores for ISX, ISF, and QSL engines, with flexible MOQ for wholesale markets.

Core Assemblies: Provides CHRA and compressor wheels for tailored needs.

B2B Focus: Caters to importers with scalable order sizes.

Chengdu Precision delivers affordable turbochargers for fleets and generators, with strong partnerships in Africa and South America.

Competitive Pricing: Balances cost and quality for budget-conscious buyers.

Fleet Support: Trusted by logistics and power generation sectors.

HighTorque specializes in turbochargers for construction and agriculture, using robotic balancing for longevity.

Rigorous Testing: High-temperature endurance tests ensure reliability.

Rugged Design: Ideal for Cummins engines in harsh environments.

Selecting a manufacturer for wholesale Cummins turbochargers requires careful evaluation to ensure quality and efficiency in your supply chain.

Choose suppliers offering OEM-equivalent turbochargers with high-grade materials like Inconel and titanium. Request third-party validation and performance data to confirm compatibility with heavy-duty diesel engines.

IATF16949 and ISO/TS16949 certifications indicate adherence to global standards, critical for B2B buyers ensuring product reliability.

Flexible MOQ (5-20 units) and ready-to-ship stock reduce lead times. Elecdurauto's multi-warehouse system ensures rapid delivery for importers.

Suppliers with large inventories support bulk orders, minimizing disruptions in global supply chains.

Look for 12-18 month warranties, detailed installation guides, and responsive support. Eco-friendly manufacturing adds value for ESG-focused distributors.

Choose manufacturers investing in VGTs and e-turbos to meet evolving B2B demands.

Chinese manufacturers offer export-friendly terms like FOB, CIF, and DDP, with lead times of 7-25 days. Elecdurauto's global logistics and digital tracking enhance supply chain transparency for distributors.

Custom Branding: Supports private labeling for resale markets.

Global Logistics: Multi-warehouse systems ensure efficient shipping.

Digital Tools: Blockchain and tracking systems improve transparency.

This FAQ section addresses key queries from importers, distributors, and fleet operators searching for "Cummins turbocharger manufacturers in China," "OEM replacement turbochargers for heavy-duty diesel engines," and "wholesale turbochargers from China." Optimized for SEO with long-tail keywords, it provides detailed answers to guide B2B sourcing decisions in 2025.

Yes, top Chinese manufacturers like Elecdurauto produce OEM-quality Cummins turbochargers using high-grade materials such as Inconel for turbine housings and precision-balanced rotors. These replacements undergo rigorous testing for durability, ensuring compatibility with heavy-duty diesel engines like ISX15 and QSB6.7. Many achieve 100% OEM performance with low failure rates, as verified by ISO/TS16949 certifications, making them reliable for B2B buyers in trucking and mining applications.

Absolutely, most Cummins turbocharger manufacturers in China, including Elecdurauto and Shanghai TurboWorks, support private labeling and custom branding for wholesale orders. This allows B2B distributors to rebrand OEM-equivalent turbochargers for resale in markets like Europe or South America, enhancing brand value while maintaining quality standards. Minimum order quantities (MOQs) for customized labeling typically start at 50-100 units.

MOQs for wholesale Cummins turbochargers vary by supplier but generally range from 5-20 units per model for standard stock items, with higher thresholds (50+ units) for customizations. Manufacturers like Guangzhou DieselTech offer flexible small MOQ options for emerging distributors, while Elecdurauto's large inventory supports low-MOQ bulk procurement, ideal for B2B buyers testing the market or scaling up supply chains.

To verify quality, request sample turbochargers, batch inspection reports, or third-party certifications from suppliers. Elecdurauto provides detailed performance testing data, including dynamic balancing and high-pressure endurance tests, ensuring OEM compatibility for heavy-duty diesel engines. Conduct site audits or use platforms like Alibaba's Trade Assurance for added security, helping B2B importers mitigate risks in sourcing from China.

High-quality replacement Cummins turbochargers from China, such as those from Ningbo HighFlow, achieve 100% compatibility and performance with OEM units but at 30-40% lower costs. They use reverse-engineered designs with identical fitment for models like HX50 and HE351, often featuring upgrades like ceramic bearings for better durability in heavy-duty applications. Always check for IATF16949 certification to ensure equivalence.

Chinese manufacturers incorporate advanced technologies like variable geometry turbines (VGTs) and low-emission coatings in Cummins-compatible turbochargers to comply with Euro VI, EPA, and China National VI standards. Suppliers like Wuxi BoostLine design units that reduce NOx emissions by optimizing airflow, supporting B2B buyers in fleet upgrades. Performance reports from testing labs confirm adherence, making them suitable for global wholesale markets.

Sourcing from China offers cost savings (up to 50% vs. OEM), vast inventory availability, and fast export logistics for heavy-duty diesel turbochargers. B2B distributors benefit from customizable options, flexible MOQs, and reliable supply chains, as seen with top manufacturers like Elecdurauto. Additional advantages include access to innovations like e-turbos and eco-friendly production, reducing overall procurement risks in 2025.

Reputable suppliers provide comprehensive export support, including FOB/CIF/DDP terms, customs documentation, and tariff guidance. Elecdurauto assists with HS codes for turbochargers (841480) and partners with freight forwarders for global shipping, with lead times of 7-25 days. B2B buyers can leverage free trade agreements like RCEP to minimize tariffs, ensuring smooth imports for wholesale heavy-duty diesel parts.

Yes, Chinese manufacturers like Fengcheng PowerTech offer customization for specific Cummins models (e.g., 6BT or ISX series), including tailored CHRA cartridges, compressor wheels, or VGT actuators. This involves engineering consultations to match OEM specs, ideal for B2B distributors needing bespoke solutions for trucks or generators. Customization MOQs start at 20-50 units, with prototypes available for testing.

Warranties typically range from 12-18 months, covering defects in materials and workmanship for OEM-quality replacements. Elecdurauto extends up to 18 months with after-sales support, including technical guidance for installation on heavy-duty diesel engines. For B2B wholesale buyers, extended warranties are available with bulk orders, ensuring long-term reliability and minimal downtime.

Evaluate factors like certifications (IATF16949), export experience, MOQ flexibility, and customer reviews. Top choices like Elecdurauto stand out for large stock, OEM compatibility, and global partnerships. For SEO-optimized sourcing, search for "top Cummins turbocharger manufacturers China" and verify via site visits or samples to align with your B2B supply chain needs.

OEM turbochargers are Cummins-branded originals, while Chinese aftermarket versions (e.g., from Wuxi EngineBoost) are OEM-equivalent replicas offering similar performance at lower costs. Aftermarket options often include enhancements like better heat resistance, but always ensure compatibility through specs matching. B2B buyers prefer aftermarket for wholesale due to affordability without sacrificing quality in heavy-duty applications.

Shipping costs depend on volume and method: air freight for samples (higher cost, 3-7 days) vs. sea freight for bulk (lower cost, 20-40 days). Lead times from manufacturers like Shandong TurboMach are 7-25 days for stock items. B2B distributors can negotiate CIF terms to include costs, with Elecdurauto offering multi-warehouse options to reduce times for exports to Europe or Africa.

Risks include quality inconsistencies or supply delays, mitigated by choosing certified suppliers, using escrow payments, and requesting samples. Platforms like Made-in-China provide verified listings, and partnering with experienced firms like Chengdu Precision Turbo Systems ensures compliance. For B2B importers, insurance and detailed contracts protect against issues in heavy-duty diesel parts procurement.

The market has matured with a focus on sustainability, smart tech, and electrification compatibility, driven by demand for OEM replacements. Manufacturers now export advanced VGT and twin-turbo systems for Cummins engines, with increased capacity to meet global shortages. B2B buyers benefit from competitive pricing and innovations, positioning China as a leader in wholesale heavy-duty diesel turbochargers.

For B2B buyers and distributors, partnering with a reliable manufacturer is critical for maintaining OEM-quality standards and competitive pricing. Elecdurauto excels with its extensive inventory, custom branding, and global export expertise, making it the ideal choice for sourcing Cummins turbochargers in 2025. Contact Elecdurauto to strengthen your supply chain and meet the demands of heavy-duty diesel engine markets.